Internal Controls Aren't Just for Audits; They're for Resilience

- HK Borah

- Apr 26, 2024

- 2 min read

For many business leaders, the topic of internal controls can feel like a dry, compliance-driven exercise. It's often viewed as a "cost of doing business"—a set of rules and processes that are necessary to pass an audit but are disconnected from the real work of driving growth. This is a dangerous misconception. A robust system of internal controls is not a bureaucratic burden; it is a fundamental pillar of a resilient and scalable business. It is the framework that protects your company from fraud, error, and inefficiency, and it is a critical enabler of long-term, sustainable growth.

A company with weak internal controls is a company that is flying blind. It is vulnerable to financial misstatements, operational breakdowns, and reputational damage. A company with strong internal controls, on the other hand, is a company that is built to last. It has the systems and processes in place to ensure the integrity of its financial reporting, the efficiency of its operations, and the trust of its stakeholders. Strong internal controls are not just for your auditors; they are for you.

The Three Layers of a Resilient Internal Control System

A robust internal control framework is built on three key layers of defense.

1. Preventive Controls

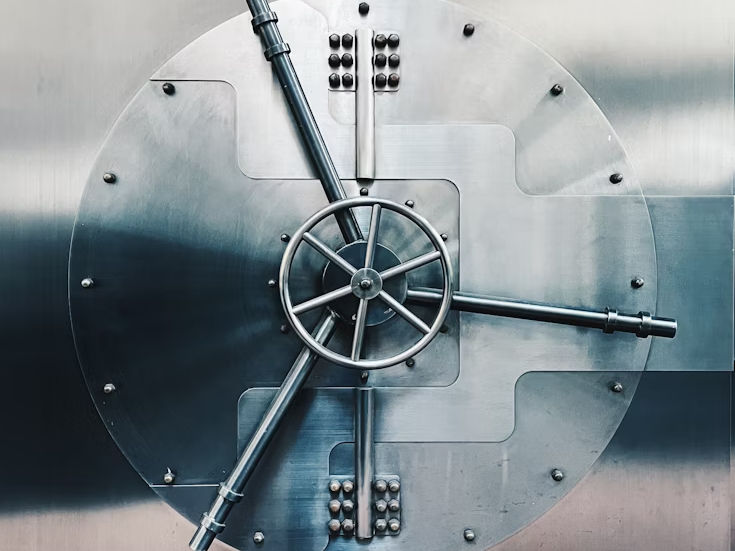

These are the proactive controls designed to prevent errors or fraud from happening in the first place. This includes things like the segregation of duties (ensuring that no single individual has control over every aspect of a financial transaction), required approvals for large expenditures, and strong password policies for your IT systems. Preventive controls are your first and most important line of defense. They are the locks on the door that keep your assets and your data safe.

2. Detective Controls

No system of preventive controls is foolproof. Detective controls are designed to identify errors or irregularities after they have occurred. This includes things like monthly bank reconciliations, regular physical inventory counts, and internal audits. The goal of detective controls is to catch problems quickly, before they can escalate into larger issues. They are the alarm system that alerts you to a potential problem.

3. Corrective Controls

When a problem is detected, you must have a clear process for correcting it. Corrective controls are the steps you take to remediate an issue and to prevent it from happening again. This may include updating a process, providing additional training to your team, or implementing a new software tool. A strong internal control system is a learning system. It is constantly being updated and improved based on the issues that are identified through the detective control process.

A strong system of internal controls is a hallmark of a well-run and professionally managed business. It is a critical foundation for scalable growth and a key indicator of your company's long-term health to investors, lenders, and potential acquirers. At PICO, we help our clients move beyond a simple compliance mindset to build a truly resilient internal control framework. Our Internal Controls Stress Testing service is designed to identify potential weaknesses in your key financial and operational controls before they can be exploited or fail an audit, giving you the peace of mind that comes from knowing your business is built on a solid foundation.

Comments